Look out, EV tax credit rules will change… again

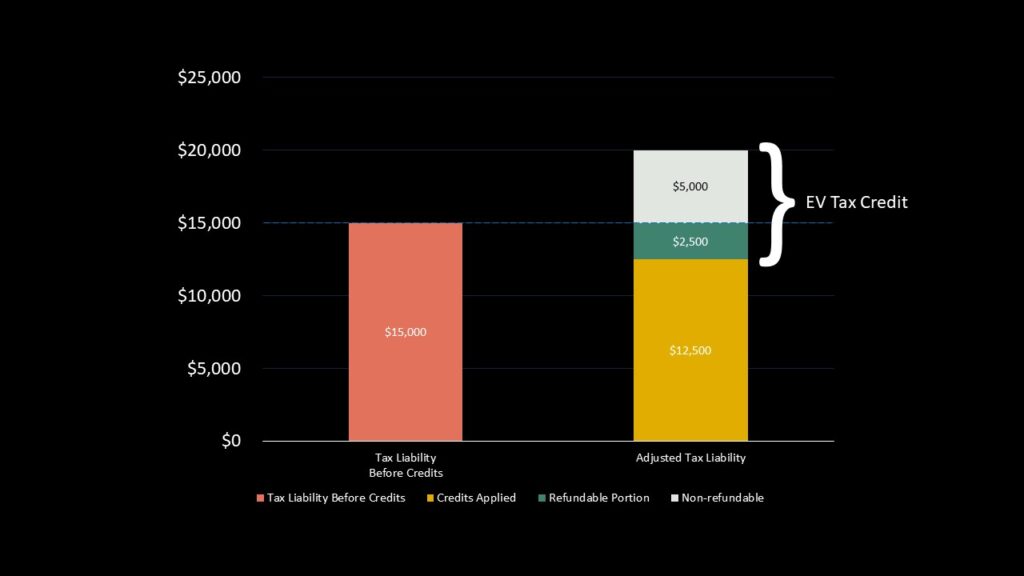

Surprise! The rules around federal EV tax credits are changing again, but this time, they make a little more sense despite there being even more churn in the eligibility of some models. Buyers will be able to apply the up to $7,500 federal tax credit at the point of sale in 2024, rather than waiting until year’s end to see the benefit. More than 7,000 dealers have signed up to dole out the benefits, but that’s only a fraction of the number of franchised dealerships in the country.

There are almost 17,000 dealers in the U.S., so there’s a lot of ground left to cover. It likely won’t be easy going, either, as thousands of dealers penned a letter to President Biden last month, asking him to pump the brakes on issuing new EV regulations. Some state dealer associations are actively working against local regulation changes, with some creating elaborate anti-EV campaigns.

Dealers have to register with the IRS to issue the credits, but registration has only been open since November 1, so there’s still time for more to sign on. The changes could make buying a new EV significantly less expensive. New EVs are eligible for up to $7,500, and used models can net a $4,000 credit, but the rules have become stricter on which vehicles qualify.

General Motors is one automaker that will be affected by the new rules in January, as two of its latest models are expected to temporarily lose credits due to component sourcing locations. The automaker plans to correct the issue and requalify the Cadillac Lyriq and Chevrolet Blazer EV, saying that it expects to have them back into compliance early in 2024.