Hello, and welcome back to your regular dose of EVs Explained! Many altruistic reasons exist to switch over from a gas guzzler to an electric vehicle, like keeping hush for the neighbors or allegedly doing your part to help God’s green earth and all. But today’s topic is a little more self-interested, and that’s okay. Here. Have some EV tax credits. On Uncle Sam. But what are they?

Well, hey. You know how Tesla has been raving on about how their Model 3s are now sub-30-grand cars? Well, technically, they are and they aren’t. They’re forty-grand cars that Tesla is advertising as less by factoring in potential gas savings plus a handy little pick-me-up from the feds just for opting for an electric vehicle over a baby seal-clubbing Sonata (to Tesla-stans and Hyundai fans, that’s a joke). That’s the oh-so-desirable tax credits, my friends.

That’s correct. Right now, you can get a cool chunk of cash when purchasing an EV. And in this explainer, we’ll be going over what an EV tax credit is, what you need to qualify, and how it will change looking forward. No tech lessons today. Right now, it’s all about the moolah!

Tax liability and the EV tax credit

Last summer, the Inflation Reduction Act of 2022 was passed into law by Congress. The bill includes revisions to the credit for qualified plug-in EVs and fuel cell electric vehicles purchased from 2023 to 2032. Purchasers of this type of vehicle may now be eligible for a tax credit of up to $7,500 for new EVs and up to $4,000 for used EVs (limited to 30% of the sale price). This would lower your tax liability for whatever you qualify for up to that amount.

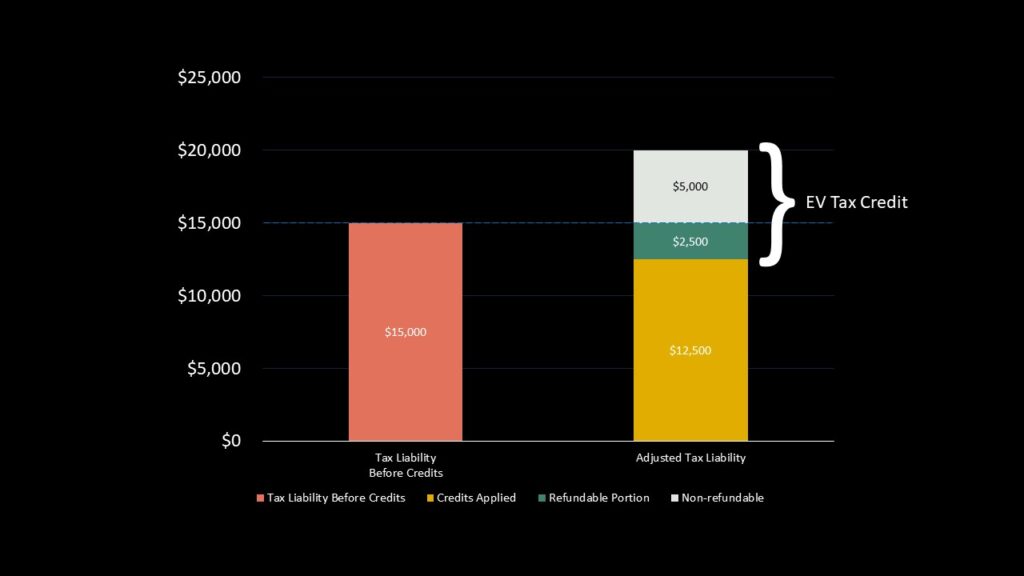

It is important to note this is a nonrefundable tax credit. You need to have enough tax liability if you want to capture the full amount that the vehicle you’re purchasing is qualifying for. In layman’s terms, what that means is that you have already exceeded your allowable. You will not see any overage as a refund during the approaching tax season and you cannot apply excess credit to the following tax year.

“Wait, stop. What exactly is tax liability?”

Simply put, it’s just the total amount of money owed at the end of the tax year. If you are a general W-2 employee, every paycheck you receive from your company already has taxes taken out automatically. That goes to your tax liability throughout the year. At the end of the year, when filing your tax return, this is the time when you add in any credits and deductions that you qualify for. Once applied, that number you’ve arrived at is now your adjusted tax liability. If you paid more if you’re W-2, you get a refund. If you didn’t pay enough to cover, well, you owe the IRS money. Tax liability is the total, not the difference between what was owed and what was paid.

Phew.

“But Mister, can you use ‘tax credits’ in a sentence?”

So a qualifying vehicle such as a Chevy Bolt purchased today (assuming you qualify for the full amount) will let you realize $7,500 toward your tax liability come April of 2024 when you file your taxes. You will use Form 8936 when filing your federal income taxes. Conversely, if you started with a daily low tax liability and have already lowered it through other credits, such as claiming dependents, it’s possible that there isn’t enough liability left to receive the full $7,500. You only realize what you have remaining in your tax liability.

The bill allows for one credit per vehicle. You can claim a tax credit for every qualified vehicle you purchase. However, there are still income limits to be mindful of, and since your tax liability can only be so much, the tax credits you’d be eligible for will also only be so much.

Sorry. No infinite money glitch for flipping a bunch of EVs. You can’t Forza Auction House hack your way out of this one.

What vehicles qualify?

Many new EVs are eligible for the full amount of $7,500 though there are exceptions. It’s best to think of the tax credit in two different components — the battery requirement and the critical minerals requirement. Each is responsible for a partial credit of $3,750, each adding up to half of the new tax credit.

For the battery requirement, a certain percentage of the vehicle’s battery must be assembled or manufactured in North America. Over the next ten years when the Inflation Reduction Act of 2022 is in effect, the required percentage is going up for manufacturers. Those percentages are as follows:

- 2023: 50%

- 2024: 60%

- 2025: 60%

- 2026: 70%

- 2027: 80%

- 2028: 90%

- 2029-2032: 100%

For the critical minerals requirement, we’re dealing with a similar story. A certain percentage (that will increase over the decade) of the minerals in the car’s battery must be extracted or processed within the United States or within a country that has a free-trade agreement with the U.S. Percentages are as follows:

- 2023: 40%

- 2024: 50%

- 2025: 60%

- 2026: 70%

- 2027-2032: 80%

So while a vehicle like the Tesla Model 3 meets both the battery and critical minerals requirement (granting it eligibility for the full $7,500) a vehicle like the Nissan Leaf only meets the battery requirement. Thus, it is only eligible for $3,750.

A couple more stipulations exist as well such as restricting the sourcing of battery components or critical minerals from foreign countries of concern such as China. Those go into effect in 2024 and 2025, respectively. However, if you seek the tax credit amount for a specific EV vehicle, the most up-to-date information exists at fueleconomy.gov where you can look up eligible models and filter based on purchase scenario, model year, and vehicle type, among other stats like MPGe and total range.

How do you qualify?

Beyond the vehicle qualifications, you must also consider the personal qualifications. In order to qualify for the credit, the vehicle you are purchasing must be for your own use (not resale) and primarily driven in the United States.

Your tax filing status and modified adjusted gross income are also part of the picture. The following are the upper-income limits for each status:

- $300,000 for married couples filing jointly

- $225,000 for heads of households

- $150,000 for all other filers

2024 and onward

As stated in the earlier explanation, the tax credit is currently set up in which you claim the tax credit when filing your taxes. However, in 2024, a new option will allow a purchaser of a clean vehicle to transfer that credit to an eligible entity. What is an eligible entity? Well, the dealer that sold it to you.

Psst. It’s the car.

This means you can fully realize the tax credit at the time of sale, turning it into an upfront discount applied toward your purchase. So if you were to purchase that Chevy Bolt in 2024, instead of paying the list price of $26,500, you could transfer that credit, getting the EV for $19,500 – provided you qualify. The option to transfer credit would be effective as of January 10, 2024.

The new system was announced Friday, October 6 , in a press release from the U.S. Department of Treasury. Within, the IRS expands on stipulations the dealer must follow (being registered with the IRS at time of sale, disclose to the taxpayer any other incentive available for the purchase of such vehicle, et cetera. et cetera.). You can find all the legal mumbo jumbo on the IRS website.

Last thoughts

With this tax credit in place, we expect to see a lot more EVs coming onto the road over the next decade. Sometimes, a little bonus is needed to push folks into going green. The tax credit is an excellent incentive for drivers to make the switch, but bear in mind that the process of qualifying and claiming said credit can be a bit overwhelming. Note that everything discussed above is meant to help demystify the EV tax credit and should not be interpreted as financial advice.

If you still have questions pertaining to your own situation, consider consulting a qualified tax professional. I’m just Joe.

This story was originally published by Joe Tilleli on 9/26/2022 and updated with new information on 10/26/2023.